The COMESA Clearing House is an institution of COMESA which facilitates settlement of cross border trade and services among member states.

It was established in 1984 (as the PTA Clearing House), under the PTA Treaty signed in 1981. However, with the liberalisation of current accounts and the repeal of exchange control restrictions, the need for the COMESA Clearing House to restructure its services to be more relevant to this liberalised market setting, was identified by COMESA Governors of Central Banks. The Clearing House was thus mandated, by its Central Bank Governors, the Ministers of Finance, the Council of Ministers and COMESA Heads of State and Government, to design and implement, among other facilities, a Payments System designed to reduce costs of regional transactions in a liberalised foreign exchange regime. The Clearing House thus introduced the Regional Payment and Settlement System – REPSS – which allows Member States to transfer funds more easily within COMESA. The facility is built on open standards and is also accessible to Non-Member States. REPSS is run by the COMESA Clearing House, headquartered in Harare, Zimbabwe.

REPSS is a Multilateral Netting System with End-of-Day Settlement in a single currency (US$ or Euro), with the system allowing for settlement in a multicurrency environment (US$, Euro or any other specified currency). The main aim of the system is to stimulate economic growth through an increase in intra-regional trade by enabling importers and exporters to pay and receive payment for goods and services through an efficient and cost effective platform. Local banks access the payment system through their respective Central Banks. Any participating bank is, therefore, able to make payments to, and receive payments from, any other participating bank. The linkages through Central Banks avoid the complex payment chains that may sometimes occur in correspondent bank arrangements. The system operates through member countries Central Banks and their corresponding banking systems.

REPSS guarantees prompt payment for exports as well as other transfers and with Central Bank involvement, eliminates mistrust among traders. This in turn increases trade within the region. The REPSS platform allows reduction in costs with the resulting savings channelled to other economically beneficial projects within COMESA.

REPSS further enables the building of trust and confidence amongst traders and commercial banks of the region and facilitates the transacting under documentary collections (ICC Publication no. 522) and ultimately on open accounts where the opening of Letters of Credit would no longer be required. Once the region moves to trading under open account, savings could reach over US $300 million under documentary collections/open account trading.

The system is operational in 9 Member States, namely at the Central Banks of DRC, Egypt, Eswatini, Kenya, Malawi, Mauritius, Rwanda, Uganda and Zambia. It is hoped that the rest of the COMESA countries will join the system in due course, in line with COMESA’s variable geometry approach to implementation of its programmes.

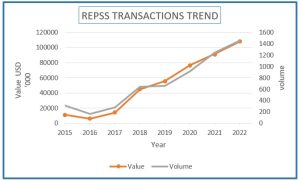

The value of transactions processed on the system is growing, reaching over US$ 388 Million over a 6-year period, as at 31 December 2022.

The near totality of transactions carried out so far on REPSS have been without Letters of Credit. Based on an estimated amount of US$ 388 million transacted over the last 6- year period and at an average cost of 5% of the value of these transactions which would have gone through Letters of Credit, importers have already saved an estimated amount of over US$ 19.4 Million by channelling their payments through REPSS.

The COMESA Authority of Heads of State and Government has been continuously reaffirming its commitment towards COMESA’s Regional Payment and Settlement System by welcoming and fully supporting REPSS as a mechanism for effecting payments within the COMESA region. The Council of Minister’s directives to Member States, in line with Article 73 of the COMESA Treaty, to settle all payments in respect of all transactions in goods and services conducted within COMESA through the Clearing House Regional Payment and Settlement System (REPSS) has also been acting as a boost to the system.

In order to further increase the use of REPSS, the COMESA Committee of Governors of Central Banks approved in November 2022 a Trade and Development Bank (TDB) Trade Finance Facility of $500million (on a three-month rolling basis) made available to traders through their respective local commercial banks, from REPSS participating Member States, through their respective Central Banks. This facility will be rolled out to Central Banks live on REPSS on the basis of expression of interests by those Central Banks and following bilateral discussions between the concerned Central Banks and TDB and CCH. Some Central Banks have already expressed interest in the facility.

With a view to opening up new markets within the region and throughout the continent under the AfCFTA, through the availability of appropriate payment channels, the Clearing House is working closely with Afreximbank in the context of interfacing REPSS with its Pan African Payment and Settlement System – PAPSS.

Contact us:

COMESA Clearing House

4 Purbeck Close

Highlands, Harare

Tel: +263-242-495189/481644

Email: info@comesach.org